Whether online or in-store, consumers today expect to be able to pay for goods and services in the manner they choose, be it credit, debit, ACH, PayPal, Venmo, etc. Consumer-facing companies have, for some time now, been investing in and integrating a wide range of payment capabilities to accommodate this expectation and provide their customers […]

Fintech

Visa taps QR payment providers for Asia digital payments

Visa has collaborated with several QR payment providers to enable streamlined touchless digital payments across Asia. Consumers can use their digital wallets to scan and pay at point-of-sale QR terminals when they travel abroad. The pilot program will begin in Singapore, and then rolled out across the region in the coming year. Visa will enable […]

How Trump’s administration may rework payments policies

The election of Donald Trump as president will shape the evolving payments landscape as his administration touches everything from stablecoins to earned wage access policies to federal antitrust priorities. With payments processes caught up in rapid change, new laws and regulatory policies put forward by his administration will be influential, for better or worse, in […]

Detroit to become largest US city to accept cryptocurrency payments

Residents will have the option beginning in mid-2025 to make the payments with the digital currency through a secure platform managed by PayPal. City leaders hope the move will help attract and retain tech startups in the Motor City. “Detroit is building a technology-friendly environment that empowers residents and entrepreneurs,” said Mayor Mike Duggan. “We […]

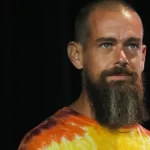

Afterpay to arrive on 24M Cash App cards

Digital payments company Block plans to add its Afterpay buy now, pay later financing option to its 24 million Cash App debit cards, Block Chief Financial Officer Amrita Ahuja said during an earnings webcast with analysts Thursday. The company didn’t specify when that will happen. Block, which is the parent company for Cash App, Afterpay […]

UBS Successfully Pilots Blockchain-based Payment Solution for Cross-Border Transactions

Global asset manager and Swiss bank UBS has developed and successfully piloted a blockchain-based payment solution, aiming to increase efficiency and transparency, as well as enable the programmability of money movements for corporate and institutional clients. The solution, dubbed UBS Digital Cash, aims to increase the transparency and security of cross-border payments with blockchain-based payments. Cross-border payments often […]

AI is Key to Personalised Services: Short Term Revenue Goals Are Stopping Investment in the Tech

Artificial intelligence (AI) is quickly becoming an essential tool in the banking industry, as the demand for personalisation is spiking. Revealing how impactful AI can really be in meeting this demand, CleverTap, the all-in-one engagement platform explored the tech’s use in the global banking landscape. In its research, titled Banking on AI: A Leader’s Guide to Customer Engagement […]

TerraPay Teams up With Suyool to Enhance Financial Accessibility in Lebanon

Money movement firm TerraPay is aiming to enhance financial accessibility in Lebanon through a new partnership with Suyool, a licensed financial ecosystem regulated by Banque du Liban. Through the new partnership, TerraPay and Suyool are aiming to address the growing demand for fast, secure, and convenient remittance services in Lebanon. Lebanon remains heavily reliant on remittances, with over $6.5billion […]

CFPB charges Navy Federal Credit Union $95 million for overdraft and junk fees

Between 2017 and 2022, Navy Federal has been illegally collecting $20 from consumers for overdraft transactions through its Optional Overdraft Protection Service (OOPS). The credit union would charge surprise fees to users even when they had enough funds to cover the transaction, if the account had a negative balance once the purchase was posted. Navy […]

Boerse Stuttgart Digital Selects Fenergo to Streamline Compliance Processes

Boerse Stuttgart Digital, the European infrastructure provider for crypto and digital assets, has forged a new partnership with Fenergo, the AI-powered KYC, client lifecycle management, and transaction monitoring solution provider. Through this partnership, Boerse Stuttgart Digital is aiming to embrace the continuing growth of Europe’s crypto market by enhancing the scalability of its infrastructure solutions, while […]