Do you find yourself mostly tapping to pay, whether by card, phone, or watch? This is a far cry from mid-2020, when a friend of mine was thwarted three times in one day from using contactless pay, as she encountered obstacles at one of the largest retailers in the US and at two of the largest grocery stores. Back in that Covid year, many merchants had not fully updated payment terminals or thoroughly trained employees to accept contactless payments. At the same time, consumers did not necessarily have contactless-enabled cards. And even with newer cards, sometimes consumers had trouble aiming at just the right spot on the payment terminal. In 2020, only around 5 percent of general-purpose (GP) in-person card payments were contactless. Those included mobile phone (wallet or app) payments.

All that is in the past.

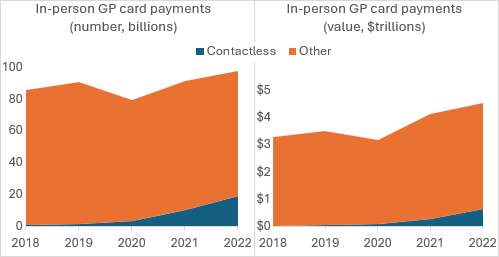

Earlier this month, the Federal Reserve Payments Study reported that from 2021 to 2022, contactless general-purpose card payments made in person doubled by number and more than doubled by value. This strong growth was a slowdown compared to the 150 percent increase in the number and value of contactless payments for each year from 2018 to 2021.

Despite this impressive trajectory of contactless payments, tapping remains less common than other ways to authorize a card payment. In 2022, just 20 percent of in-person GP card payments were contactless, using either a card or a mobile device (14 percent by value), as illustrated in the charts below.

Source: Federal Reserve Payments Study. “Other” includes chip-and-dip payments and no-chip (swipe) payments.

The other 80 percent were mostly inserted chip card payments (68 percent of the total) and some remaining no-chip payments (around 12 percent). For context, 2018 was the first year that more than half of in-person card payments used a chip, which is a requirement for contactless pay.

This data shows that, as with many aspects of payments, we like new ways but keep the old.