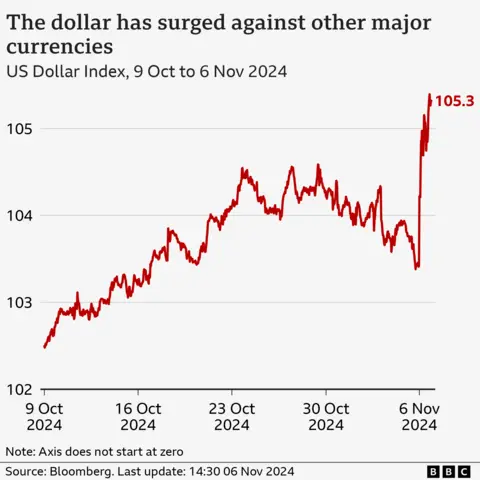

US shares hit record highs on Wall Street and the dollar posted its biggest gain in eight years as Donald Trump was re-elected to the White House in a historic win.

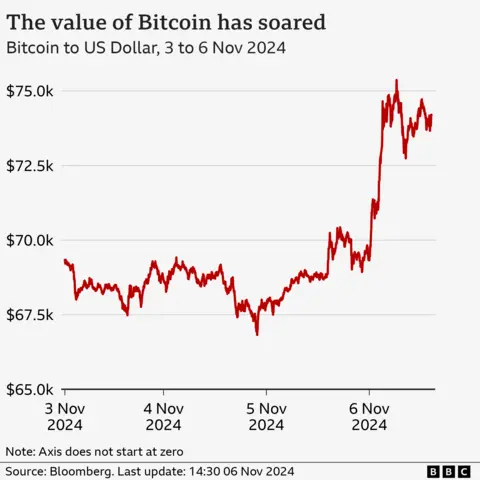

Bitcoin also hit an all-time high, following Trump’s election promise to prioritise the volatile crypto currency.

Investors were, however, betting that Trump’s plan to cut taxes and raise tariffs will push up inflation and reduce the pace of interest rate cuts.

Higher rates for longer mean investors will get better returns on savings and investments they hold in dollars.

Markets and currencies around the world shifted sharply on Wednesday following the US election news:

- The major US stock indexes soared, with banks performing particularly well

- The dollar was up by about 1.65% against a host of different currencies, including the pound, euro and the Japanese yen

- The pound sank 1.16% against the US dollar to its lowest level since August

- The FTSE 100 index, comprising the largest companies listed in the UK, rose in early trading before closing marginally down

- The euro dived 1.89% against the US dollar to its lowest level since June as the German Dax and the French CAC 40 and stock indexes closed down 1.14% and 0.51% respectively

- In Japan, the benchmark Nikkei 225 stock index ended the session up by 2.6%

- In mainland China, the Shanghai Composite Index ended 0.1% lower, while Hong Kong’s Hang Seng was down by around 2.23%

Why is Bitcoin going up?

The value of Bitcoin jumped by more than $6,600 (£5,120) to an all-time high of $75,999.04.

Trump’s stance on crypto stands in stark contrast with that of the Biden administration, which has led a sweeping crackdown on crypto firms.

He pledged to make the US “the bitcoin superpower of the world”.

During the election campaign, Trump had suggested that he could fire Gary Gensler, the chair of US regulator the Securities and Exchange Commission, who has taken legal action against several crypto firms.