Bitcoin looks wobbly as the US government prepares to auction off 69,370 bitcoins seized from the Silk Road marketplace.

The cryptocurrency market is teetering on the brink of a potential downturn as the US government clears the final legal hurdles to auction off 69,370 bitcoins seized from the defunct Silk Road marketplace.

This massive stockpile, valued at approximately $4.4 billion at current prices, could flood the market and trigger a significant drop in Bitcoin’s value, analysts warn.

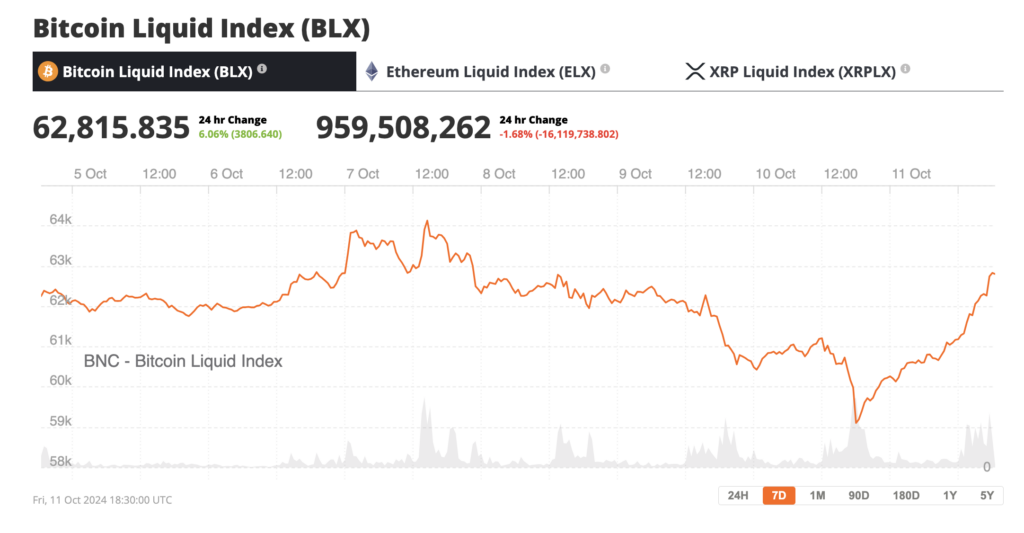

Source: BNC Bitcoin Liquid Index

Bitcoin briefly dropped under $60,000 on Thursday after poor inflation data was released in the U.S. The inflation data has reduced expectations of further rate cuts from the U.S. Federal Reserve. While the Fed surprised markets in September by cutting rates by 50 basis points (larger than the expected 25), recent inflation and employment data have cooled hopes for another big cut in November.

However, the dip below $60,000 was shortlived, with Bitcoin recovering quickly, and already back to $62,815.

The Silk Road

The Bitcoins in question were confiscated in 2013 following the FBI’s takedown of Silk Road, a notorious online black market used for the illegal trade of drugs, weapons, and other illicit goods. Ross Ulbricht, the mastermind behind Silk Road, was subsequently convicted and sentenced to life in prison. The fate of the seized bitcoins, however, remained tied up in legal battles until recently.

The Supreme Court’s recent decision not to hear an appeal regarding the ownership of the bitcoins paves the way for the US Marshals Service to proceed with the sale. This comes on the heels of Germany’s recent sale of over $2 billion worth of Bitcoin, raising concerns about the potential impact of such a large influx of cryptocurrency into the market.

Experts believe that a sudden, large-scale sale could trigger a wave of panic selling, driving Bitcoin’s price down significantly. Ryan Lee, chief analyst at Bitget Research, explains that “large-scale bitcoin sales like this often trigger market fluctuations.” The psychological impact on investors, who may anticipate further price drops, could exacerbate the situation, potentially leading to a cascade effect across the broader cryptocurrency market.

The sale’s impact could extend beyond Bitcoin’s price. Increased volatility could deter institutional investors, who are increasingly drawn to cryptocurrencies but remain wary of their inherent risks. A sharp drop in Bitcoin’s value could also negatively impact the burgeoning DeFi (decentralized finance) ecosystem, which relies heavily on Bitcoin as collateral for loans and other financial products.

While some argue that the market, with its growing institutional presence, may be able to absorb the sale without a major crash, concerns remain about the US government’s approach. BRN analyst Valentin Fournier points to Germany’s rushed sale, which resulted in below-market prices, as a cautionary tale. “To avoid a similar outcome, the government could opt to sell gradually or even retain the holdings,” Fournier suggests.

However, with the US government already transferring large amounts of Bitcoin to various exchanges, a phased approach seems unlikely. This has fueled speculation that the sale could be imminent, adding to the prevailing sense of unease within the crypto community.

The uncertainty surrounding the timing and method of the sale further contributes to market anxiety. Investors are left to speculate about the government’s intentions, leading to heightened volatility and potentially irrational market behavior.

While the long-term impact of the sale remains uncertain, the short-term outlook appears bleak. The potential for a significant price drop is real, and investors are bracing for a period of heightened volatility. Whether the market can weather this storm and rebound quickly remains to be seen, but the looming sale of the Silk Road bitcoins is undoubtedly a major test for the resilience of the cryptocurrency market.