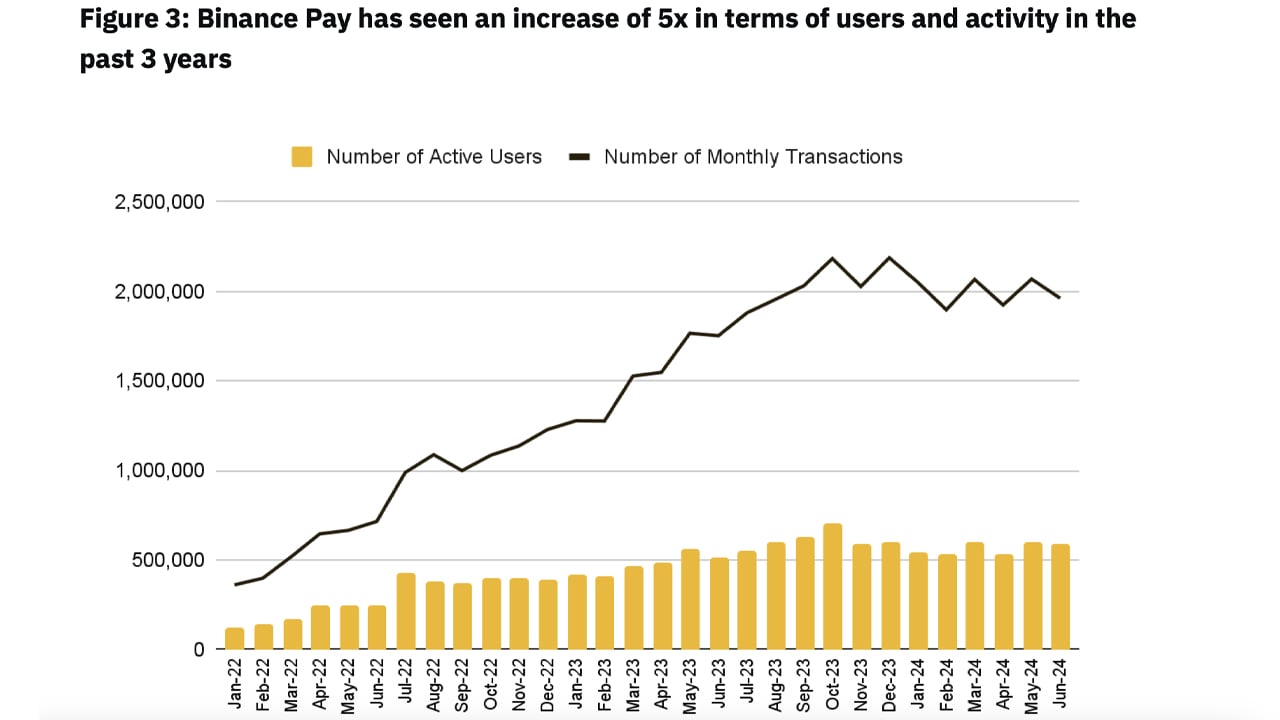

Blockchain technology is set to transform the payments industry by tackling persistent issues in cross-border transactions. A detailed report by Binance Research suggests that incorporating blockchain into payment systems could substantially lower costs and speed up settlements, offering a new direction for global payments infrastructure.

Blockchain Gains Momentum in the Payments Industry as Binance Highlights Cost and Speed Benefits

Today’s global payments system is bogged down by inefficiencies, especially in cross-border transactions where delays and high fees are major hurdles. The latest Binance Research report points out that traditional payment systems often rely on multiple intermediaries, which inflates costs and prolongs settlement times. For example, the study highlights that cross-border remittances can take as long as five business days to settle, with fees averaging 6.35% of the transaction amount, according to the World Bank.

Blockchain, on the other hand, presents a decentralized and transparent solution that removes the need for these intermediaries, cutting both costs and processing times. Binance researchers underline the potential of blockchain to simplify payment processes, particularly through stablecoins, which offer low volatility and high liquidity. The report notes that in 2023, the stablecoin market facilitated over $10.8 trillion in transactions, reflecting the growing adoption of blockchain-powered payment solutions.

The report also details how, by utilizing blockchain’s decentralized ledger technology, institutions like Visa have begun testing blockchain-based payment systems that could eventually replace traditional banking infrastructure. This transition promises quicker transactions and improves transparency and security across payment networks. However, blockchain payments still face several obstacles despite their revolutionary potential, as highlighted by the binance study.