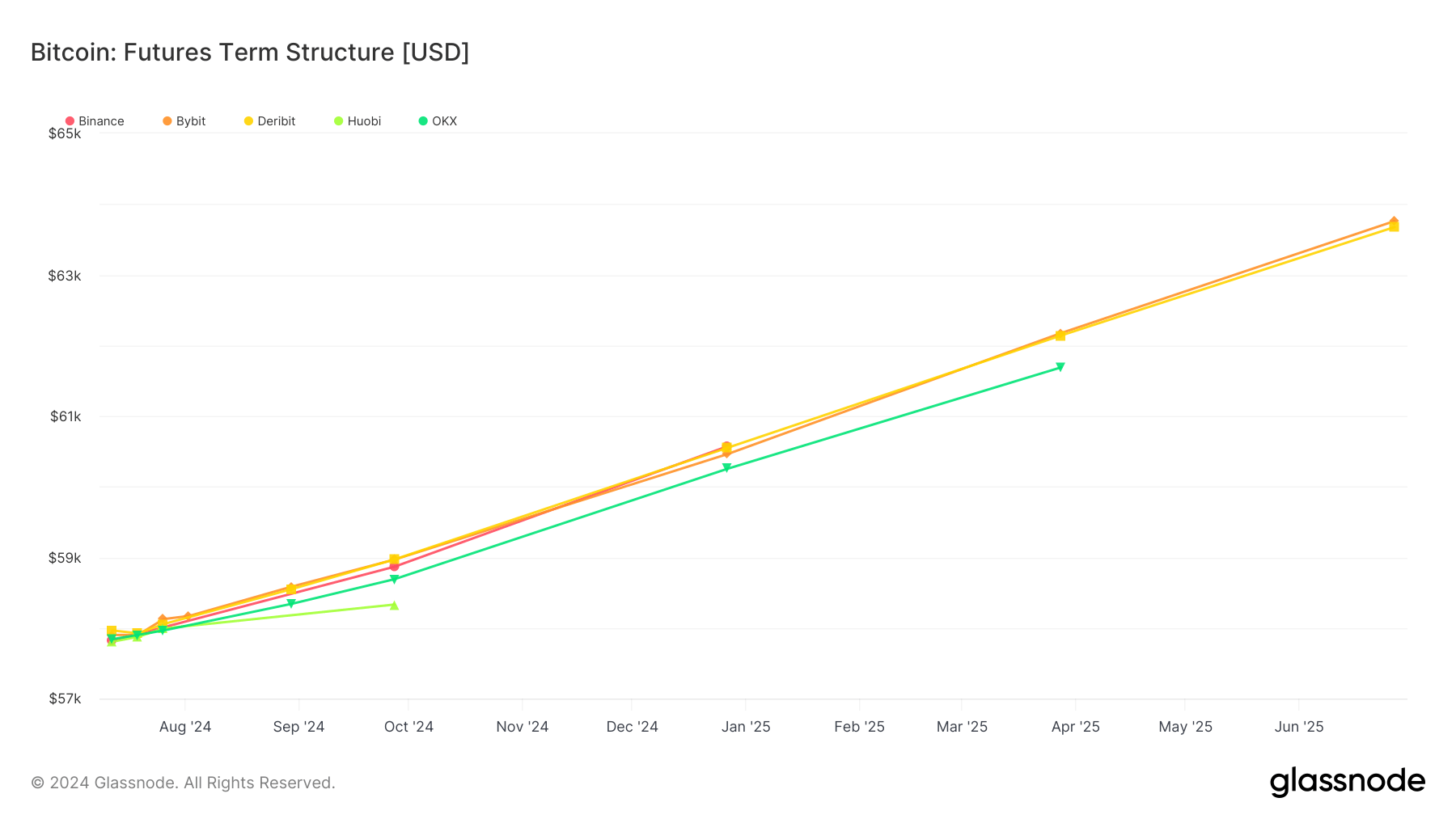

The Futures Term Structure is a graphical representation of the pricing for futures contracts expiring at increasingly distant dates into the future. The most common state of the graph, an upward slope, indicates a premium must be paid to purchase exposure, or delivery, of an asset in the future. Conversely, a downward slope indicates a discounted rate on delivery of an asset in the future. Trends and dislocations within the graph can paint a picture of supply, demand, and liquidity for futures contracts expiring on different dates.

Bitcoin futures contracts show a progressive price increase across major exchanges. The Futures Term Structure graph illustrates how futures prices from Binance, Bybit, Deribit, Huobi, and OKX rose steadily from August 2024 to June 2025. This consistent upward trend indicates a market expectation of higher Bitcoin prices over the next year.

The graph starts at approximately $58,000 for August 2024 contracts, with gradual increments peaking around $65,000 for June 2025 contracts. Notably, Deribit leads with the highest projected prices, suggesting strong market confidence in this platform’s futures market. Conversely, Huobi displays a slightly more conservative projection, reflecting different market sentiments among exchanges.

This trend of rising futures prices could imply sustained investor confidence in Bitcoin’s long-term value post the April 2024 halving. Historically, halving events have led to significant price increases due to reduced supply. The current futures pricing aligns with this historical pattern, anticipating continued price appreciation.

Market participants should consider these projections when strategizing for the upcoming months, as the futures term structure offers insights into market expectations and potential price movements.