With bitcoin’s price declining 5% over the past week, miners have been experiencing reduced revenue as the hashprice has dropped to a level not seen since May. Currently, the hashprice, which is the estimated daily value of 1 petahash per second (PH/s), is below $50 and hovering just above $47 per PH/s.

Declining Bitcoin Value Squeezes Mining Revenues and Hashrate

Over the past week, bitcoin (BTC) has decreased by 5%, and over the last 30 days, it has shown a 10% decline. This drop in price has impacted bitcoin miners and their earnings from block rewards and associated fees. Currently, miners earn between 0.076 BTC and 0.16 BTC in fees per block, significantly lower than a few months ago.

However, fees in June have exceeded those collected in May. With one day left in the month, it appears that bitcoin mining revenue for May and June will be comparable. In May, $964.24 million was collected, with $64.85 million coming from fees. From June 1 to 29, $914.43 million has been collected, with $99.62 million from fees.

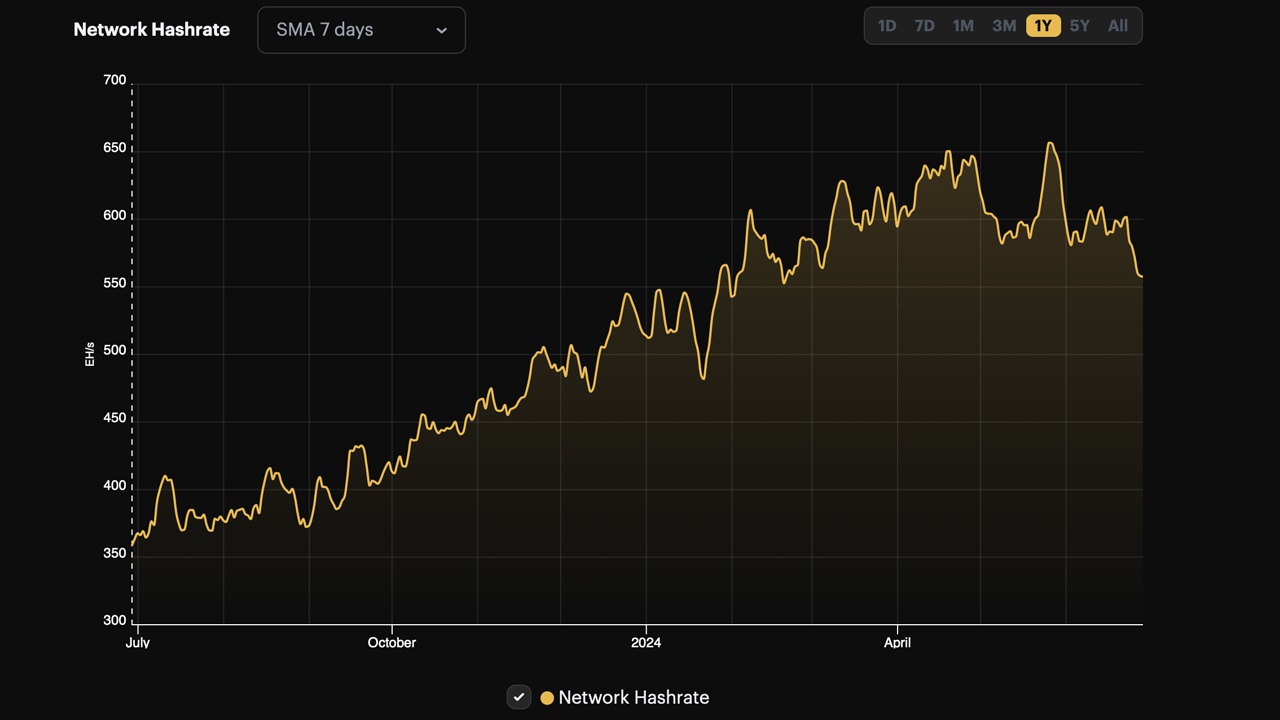

The hashprice, representing the estimated value of 1 PH/s per day, was $47.33 on Saturday, June 29, the lowest since May 1, when it was under $45 per PH/s. This decline in revenue has pressured miners, causing the overall network hashrate to decrease. As of now, the hashrate is just below 560 exahash per second (EH/s).

This indicates that nearly 100 EH/s, or roughly 96 EH/s, has exited the network since late May. Miners benefited from two difficulty adjustments, though the reductions were modest, ranging from 0.79% to 0.05% over the last two retargets. With the hashrate continuing to decline and block intervals surpassing the 10-minute mark, projections indicate a potential reduction between 4.6% and 7.3%.