Imagine a world where the money supply is finite, and there’s no dollars left to print. Sounds bizarre, right? But in the realm of Bitcoin, this scenario is not only possible but inevitable.

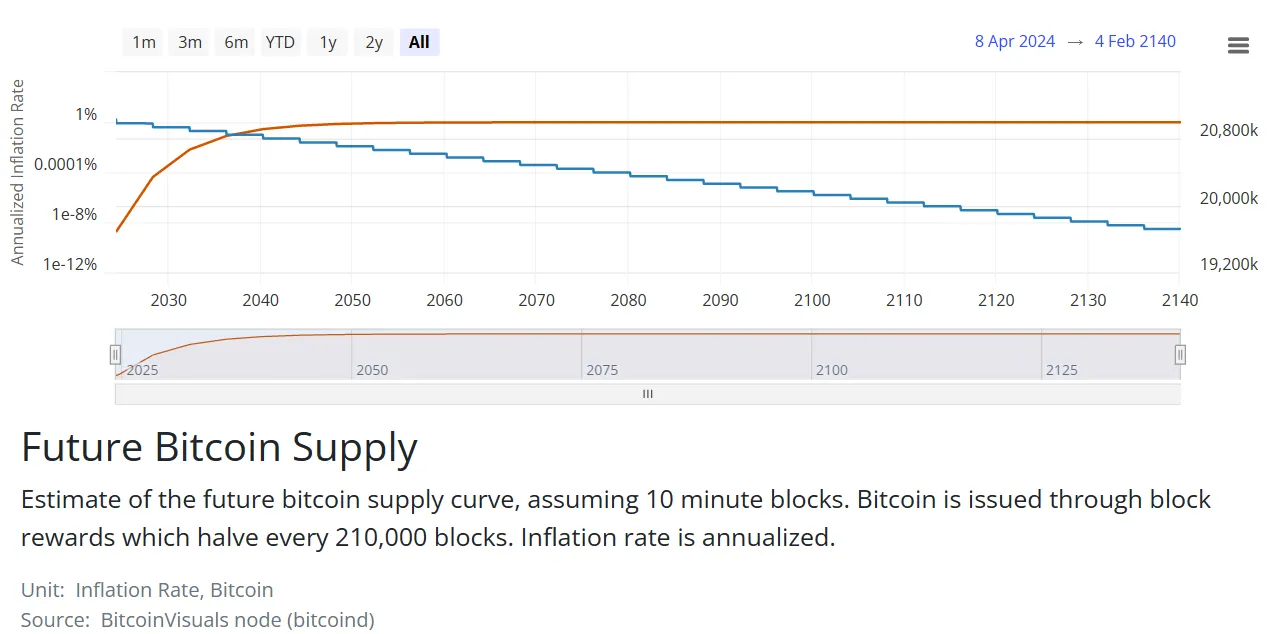

The Bitcoin network, designed with a finite supply of 21 million coins, just hit a significant milestone: the halving just chopped its inflation rate by 50% for the fourth time since its inception. As of now, 19,688,016 Bitcoin has been mined, leaving less than 2 million to be discovered over the next 120 years. This scarcity, coupled with the increasing demand for Bitcoin, is set to reshape the cryptocurrency’s future.

The roadmap to the final Bitcoin being mined is a gradual process. By 2026, 95.24% of Bitcoins will have been mined, and by 2039, this figure will reach 99.52%. The mining of the penultimate Bitcoin is projected to occur around 2093.

Fast forward a little more to 2140, the year when the last Bitcoin (or realistically, the last satoshi—the smallest denomination of Bitcoin) is expected to be mined. By this time, Bitcoin’s inflation rate would have flattened out.

The economics of the final coins

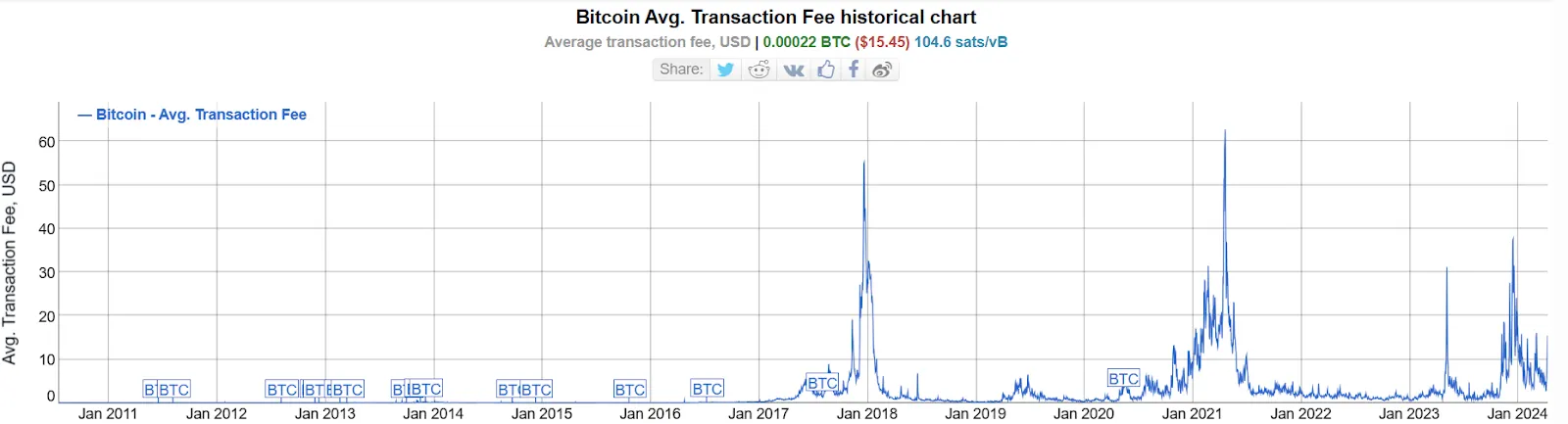

Scaling solutions and the future

Bitcoin devs, however, believe that layer-2 solutions and sidechains could tackle this problem without having to alter the core BTC configuration. The Lightning Network, in particular, has been touted as a potential solution for facilitating daily Bitcoin transactions while keeping the main blockchain reserved for high-value or batch transactions.