Blockchain, a type of distributed digital ledger technology (DLT), is a relatively new and exciting way of recording transactions in the digital age. First popularized by Bitcoin creator Satoshi Nakamoto, blockchain has the potential to revolutionize many of our modern-day processes, such as supply chain management and copyright and ownership protection, saving time and money in the process.

Read on to learn what blockchain is, how the technology works and its potential real-world applications.

What is a blockchain?

A blockchain is a digital database that stores records in chronological order. Information on a blockchain is kept in “blocks” linked to one another on a “chain” through shared mathematical algorithms. Blocks contain data, usually transaction records, including the sender and receiver of a transaction, a timestamp and the amount and type of currency sent.

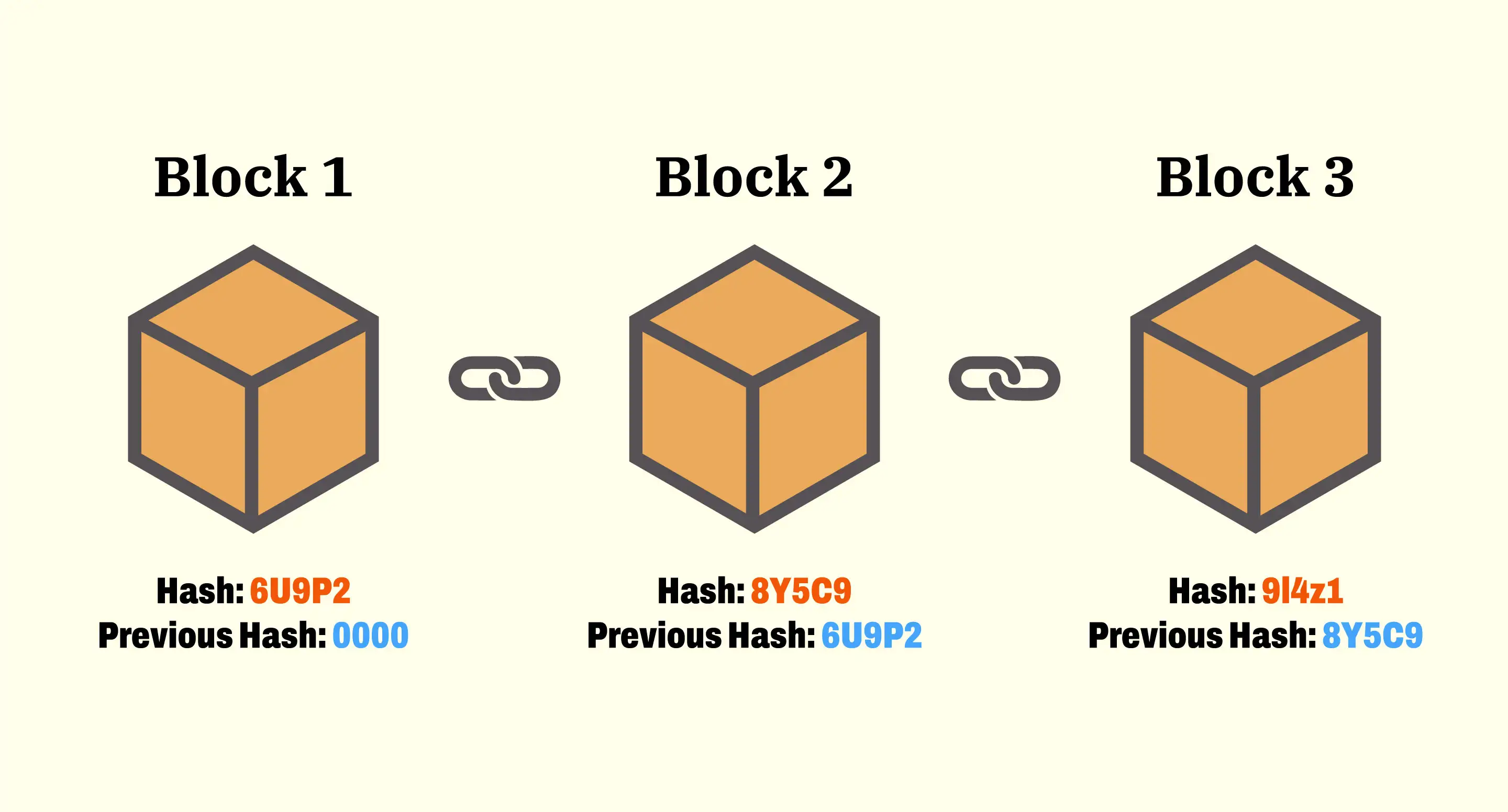

A simple string or chain of three blocks may look like this:

Blockchains differ from other types of digital databases in a couple of ways.

- Distributed databases – Data is stored on multiple servers which are scattered across several physical locations. Generally, this provides greater reliability, performance and transparency than conventional databases.

- Open source software – The entire network community can see the nuts and bolts of the code behind it, working together to discover and fix bugs, glitches or flaws.

- Data can only be added – Once a blockchain network verifies new information, it cannot be altered. New data must be verified by a majority of the network participants, meaning that the responsibility for blockchain security and trustworthiness is shared rather than taken over by a single, central entity.

How does blockchain work?

Blocks in a blockchain contain more than transaction data, they also have what’s known as a hash. Cryptographic hash functions, or hashes, are the mathematical algorithms mentioned above. These fulfill a crucial role within blockchain systems and are the reason blockchain works in the first place.

Hashes appear as a variable series of numbers and letters on a block, such as 4760RFLG07LDD492K8381O82P78C29QWMN02C1051B6624E99. This number-letter combination is generated from the data within a block and functions as its digital signature.

Each block includes the hash of the previous block in its chain. This is how blocks are linked together and how blockchain networks maintain their integrity. Modifying any content within a block would change the hash, which is a red flag for others in the network.

Put it all together, and you get a self-regulated network without intermediaries, where third parties cannot monitor or interfere with transactions.

Proof of work vs proof of stake

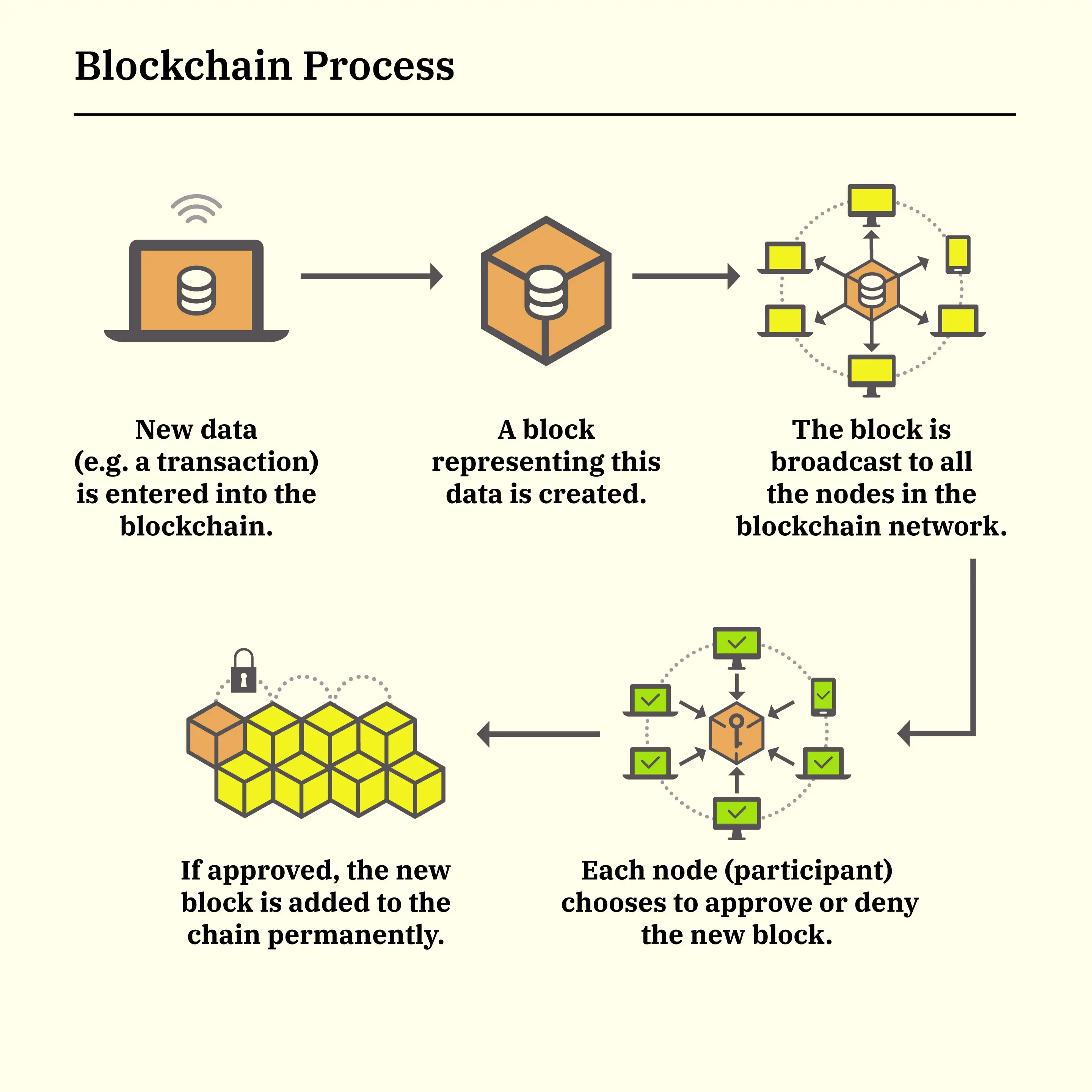

Files in a blockchain are distributed across a network of computers called nodes. To add information to a blockchain, a node must first integrate this data into a block along with the hash of the previous block. Then, they must attempt to generate a new hash.

Once a hash for the new block is generated, nodes add the block to their version of the blockchain file and broadcast the update across the network. A majority of the computers on the network must verify this new block and update their copy of the blockchain file for the update to be considered valid. If consensus is reached, the block permanently becomes part of the chain, and the computer or node that created it is rewarded.

The process in which computers compete to create new blocks is called “mining.” Blockchain networks run this competition in one of two ways:

Under a proof of work system, nodes in a blockchain directly compete to see which one can solve a complex mathematical equation first. The first one to do so gets the “proof” of their “work” and is rewarded by earning the right to mine the next block of a transaction. The miner is then rewarded for processing the block.

Under a proof of stake system, nodes are selected via a computer algorithm that employs a certain degree of randomness. Nodes that hold more of the network’s currency are more likely to get chosen, which rewards prolonged participation — their “stake” — in the network over raw computing power. Those selected to process a block are known as validators instead of miners.

Types of blockchain networks

There are four main types of networks in the blockchain ecosystem. All of them can be useful, but each one is better suited for different use cases.

| Public (permissionless) | Private (permissioned) | Hybrid (Semi-private) | Consortium | |

| Good for… | › Trust › Security › Transparency |

› Speed › Scalability |

› Flexibility › Performance |

› Scalability › Security › Cost |

| Struggles with… | › Scalability issues › Lower trades per second › High energy consumption |

› Lack of trust › Centralization |

› Transparency | > Centralization > Flexibility |

Public blockchains

Public blockchains are the first type of blockchain network to be developed. This is the type of peer-to-peer network that is associated with bitcoin, which helped popularize the technology behind it. They’re open to everyone, and all transactions on the network can be traced.

Public blockchains are also known as permissionless blockchain networks because anyone who joins can read or write to them anonymously without the need for authorization. Anyone with internet access can sign on to become an authorized node, and participants in the network are responsible for reaching agreements on the state of the chain.

Examples: Bitcoin, Ethereum, Litecoin, NEO

Private blockchains

Private blockchains are fundamentally different from public blockchains because they’re run by a central authority — they’re not entirely decentralized networks. The central authority determines who can read, write and participate in the network’s activities, which is why they’re also known as permissioned blockchain networks.

Private blockchains offer greater customizability and can be used to store sensitive data. In exchange, members are often required to pass KYC (Know Your Customer) authentication, which means they must undergo specific identity and background checks. Thus, they cannot remain anonymous.

Examples: MultiChain and Hyperledger projects, Corda

Hybrid blockchains

Hybrid or semi-private blockchains were built to offer the best of both worlds by combining elements from both public and private types of blockchain. For example, they’re run by a single entity but may employ both permission-based and permissionless systems to fine-tune access to their data.

Transactions are generally not public but may be verified if necessary. Users join the network as anonymous participants and only reveal their identities to other parties when they engage in transactions.

Examples: Dragonchain, XinFin, Ripple

Consortium blockchains

Consortium blockchains are most similar to private networks but share some characteristics with public blockchains. These are controlled by multiple central authorities and collaborate on a decentralized network.

A predefined group of individuals or nodes are in charge of reaching consensus in consortium blockchains. Like hybrid blockchains, the ability to read or write on the network may be public or restricted to select participants.

Examples: Marco Polo, Quorum, Energy Web Foundation, IBM Food Trust

What is blockchain used for?

Blockchain is most frequently associated with cryptocurrency and NFTs, but its numerous applications go far beyond that. Blockchain has already had a marked impact on several sectors of the economy thanks to its novel use in solving issues of transparency and cost in data processing.

After all, any kind of data can be stored in a blockchain, not just financial records.

Cryptocurrency

Digital currency is the most well-known of all blockchain applications. Cryptocurrency has experienced a pronounced shift into the mainstream during the last couple of years. Popular crypto such as bitcoin, ether, litecoin and dogecoin are no longer niche products: Venmo users can buy Bitcoin and three other coins on the app, firms like Visa and Paypal have incorporated crypto into their payment infrastructures and many financial advisors now consider these digital assets serious, albeit high-risk investments.

Each cryptocurrency has its own, unique blockchain where transactions are combined into blocks and then linked together. For example, the Bitcoin blockchain and Ethereum blockchain do not interact. The cryptographic nature of blockchain networks minimizes the risk of your financial information or identity being compromised, allowing for anonymous and more secure transactions.

If you’re interested in learning more about cryptocurrencies and investing in crypto, take a look at our lists of the best crypto wallets and the best crypto exchanges.