One of the largest global fintech apps offering banking and financial services will start to provide more of its offerings for free in the U.S. starting Tuesday.

Revolut, which started in the United Kingdom and quietly launched in the U.S. in March 2020, is cutting down the number of fees its customers potentially pay. Under Tuesday’s changes, customers will be able to make 10 international remittance payments a month to anyone in 30 countries, as well as withdraw up to $1,200 from out-of-network ATMs each month without incurring fees. Additionally, Revolut U.S. customers will be able to trade up to $200,000 per month in cryptocurrency commission-free. In comparison, Robinhood offers commission-free cryptocurrency trading while Coinbase charges between 0.04% and 0.50% per trade.

“If you’re a power user of crypto and you want to use more than $200,000, there’s going to be a fee,” CEO Ronald Oliveira told Fortune. But most of Revolut’s customers should fall under that limit, he says. “Most of our customers, it’s just part of their choices that they want to have to diversify and spread their risk and grow their net worth.”

Revolut, which launched in 2015, now has more than 16 million customers worldwide and does 150 million transactions a month. It’s one of the big European neobanks, along with Monzo and N26, that’s making a push into the U.S. market. It’s also the latest fintech to delve deeper into the crypto space. Venmo, for example, started allowing customers to buy, sell, and hold crypto in April and then in August started allowing users to convert cash-back rewards into crypto.

Revolut currently offers three pricing plans: a free plan, a $9.99 premium plan, and the $16.99 monthly “metal” plan. The average monthly fee for interest-bearing checking accounts at traditional banks was $15.50 in 2020, according to Bankrate. Noninterest accounts had an average monthly fee of $5.27.

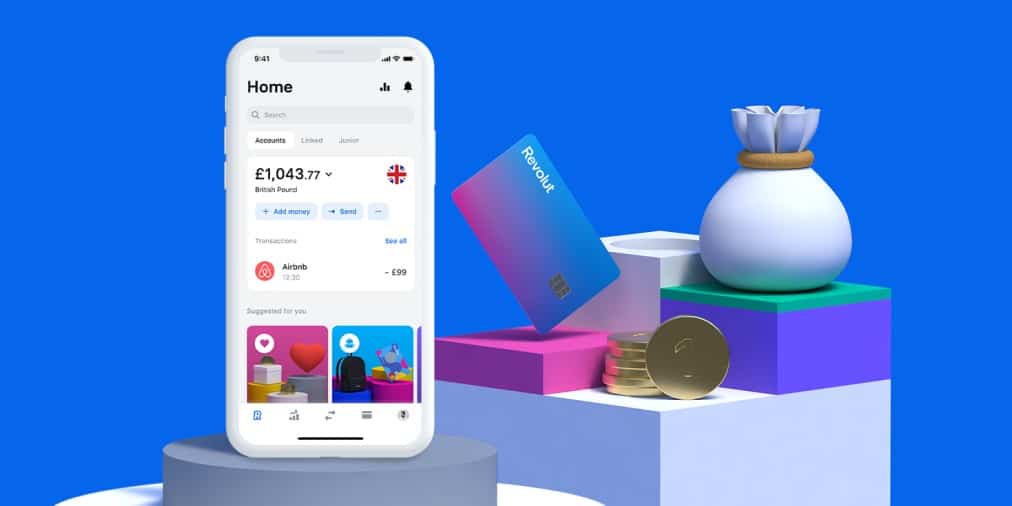

Starting Tuesday, Revolut customers in the U.S. will also be able to access junior accounts that they can set up for kids ages 6 to 17 to use. These junior accounts will offer personalized cards and app access, but the accounts can be controlled by parents.

“Starting on Oct. 19, all Revolut users in the U.S. will be able to access our fee-free services, and about 90% of our current users—just based on the various Revolut products they use—will feel the immediate impact of financial freedom,” Oliveira said.

If customers surpass the $1,200 withdrawal cap for out-of-network ATMs, Revolut applies a 2% “fair usage fee” for customers across all plans. This fee previously kicked in for free users withdrawing more than $200 at out-of-network ATMs each month. Revolut has partnered with Allpoint and has 55,000 fee-free ATMs in its network for customers.

Tuesday’s changes are only the start, Oliveira said, noting that Revolut is looking to add credit features soon in the U.S., but said the company has not yet committed to a timeline on that rollout. Currently, Revolut has more than 300,000 U.S.-based customers who have downloaded its app.