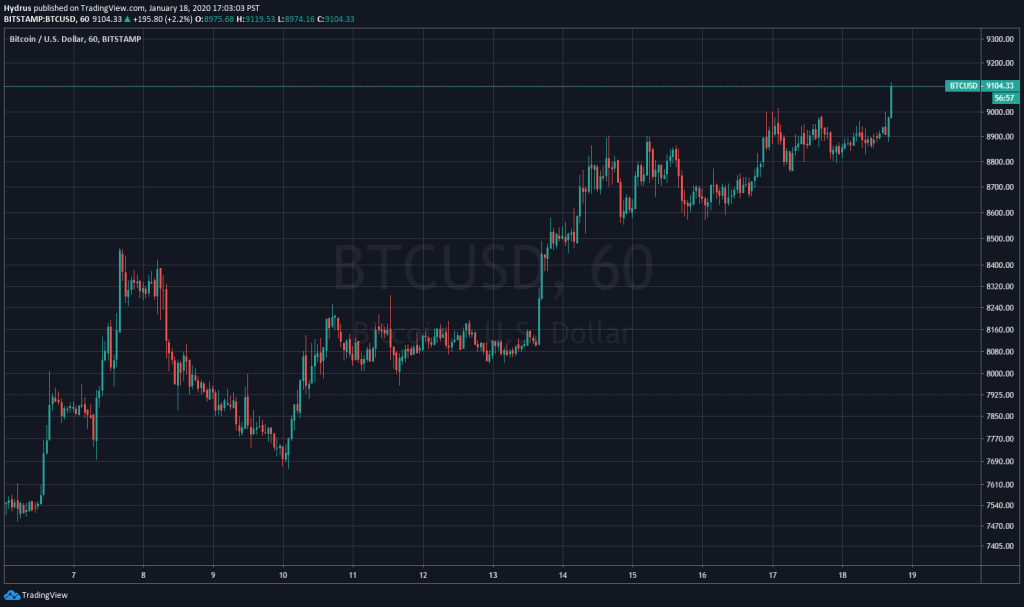

Over the past two hours, Bitcoin (BTC) has started to break out of a consolidation pattern that has trapped the price of the cryptocurrency in the high-$8,000s for some two days. In fact, just minutes ago as of the time of writing this article, the leading crypto asset tapped $9,120, surging higher as the weekly candle’s close approaches, boding well for bulls.

While Bitcoin has retraced slightly since then, returning to settle around $9,000, analysts say that this breakout, which has allowed BTC’s price to reach a multi-month high, is a precursor to even more gains in the coming days.

Bullish On Bitcoin: Analysts Expect Further Upside

Firstly, CryptoDude earlier Saturday noted that $9,080 is a “critical level” from a high time frame perspective for Bitcoin. If BTC manages to hold above this key resistance on a weekly basis when the candle closes on Sunday night, it will indicate that there is a macro reversal on the horizon, one that will bring BTC back to the $14,000 high seen last year and potentially beyond, especially with the upcoming halving.

On a shorter-term time frame, trader CryptoBirb noted that this latest surge has allowed Bitcoin to break above a flat channel that BTC has traded in for nearly a week now, which has a low of $8,555 and a high of $9,000. He expects a breakout of the channel to bring Bitcoin 4% higher from where it is now to $9,400.

Also, as reported by NewsBTC previously, trader Filb Filb noted that he expects for BTC to soon make a raid on the previous resistance level of $9,555, noting that this is where the price of the cryptocurrency topped in October and early-November in the wake of the now-infamous 40% “China pump.”

BTC reaching this level would satisfy textbook market trends of assets visiting support and resistance levels multiple times before establishing a direction.

Filb Filb called Bitcoin’s 40% surge to near $10,000, then the subsequent to collapse by 35% to the low-$6,000s to interact with the “miners bottom range,” resulting in the trader having quite the prestigious track record.