Bitcoin is again feeling the pull of gravity amid a rally in gold – a classic safe haven asset.

The premiere cryptocurrency topped out at highs near $9,100 on May 30 to hit a 2.5-week low of $7,432 on June 4.

The pullback was expected as technical charts were reporting bullish exhaustion. After all, the cryptocurrency decoupled from equity markets and rallied by nearly $4,000 in May.

Even so, the correction is noteworthy as it is accompanied by a sharp rally in gold prices. The yellow metal picked up a bid at $1,275 per Oz on May 30 and climbed to $1,344 per Oz on Wednesday – the highest level since Feb. 20.

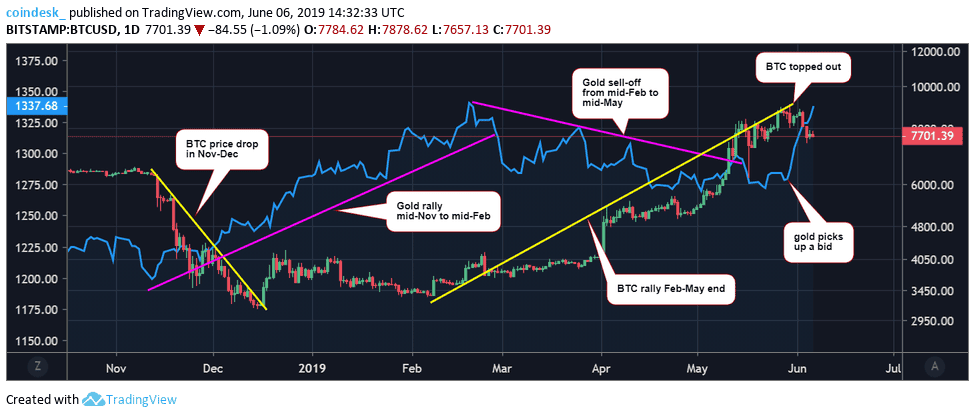

Bitcoin and Gold comparison

As seen above, the inverse relationship has been in place since the final quarter of 2018.

On Nov. 14, BTC dived below the long-held support of $6,000, reviving the bear market which had come to a halt near that psychological support in five months to October. By mid-December, BTC was trading at 15-month lows near $3,100.

During the same time frame, gold went from $1,200 to $1,300 and further extended the rally to $1,346 (Feb. 20 high).

However, by early May, gold was roughly down 6 percent from February highs, while BTC was trading at $5,500, representing a 76 percent rise on December lows near $3,100.

The inverse correlation weakened somewhat in May with gold trading the range of $1,300-$1,270 amid BTC’s sharp rise to $9,000.

The two assets, however, are again moving in opposite directions, as mentioned earlier. It is worth noting that correlation doesn’t imply causation.

Gold’s recent rally is likely associated with markets aggressively pulling forward Federal Reserve (Fed) interest rate cut expectations.

For instance, the probability that the Fed would cut rates in July rose to 72 percent earlier this week – up significantly from 30 percent seen in early May. Further, the Fed funds futures market is now pricing three rate cuts for this year.

It is worth noting that correlation does not imply causation. While gold – a zero-yielding asset – is cheering increased prospects of a drop in US borrowing costs, bitcoin is taking a hit, possibly due to chart-driven factors.

That said, the inverse relationship warrants attention and potential toppy price action in gold could be considered an advance warning of a bullish reversal in bitcoin.