Alex Cyriac was 33, single and healthy when he got a wake-up call about medical costs in retirement. His mom confided she’d stopped taking a medication because the co-pay under her Medicare drug plan had risen $200 a month. Cyriac insisted she fill her prescription and said he’d pick up the tab. “I had naively assumed that when you retire you have Medicare,’’ he says.

Shocked by how high out-of-pocket costs for seniors can be, Cyriac called his best friend, Shobin Uralil, to ask whether his parents were prepared. It was a natural question. The two knew each other through their parents: immigrants from southern India who met up at weddings, birthdays and religious conventions staged by their small Knanaya Christian sect. Uralil responded that his parents hadn’t saved for retiree healthcare costs either and added that he himself had just been socked with large out-of-pocket medical bills for the birth of his first child.

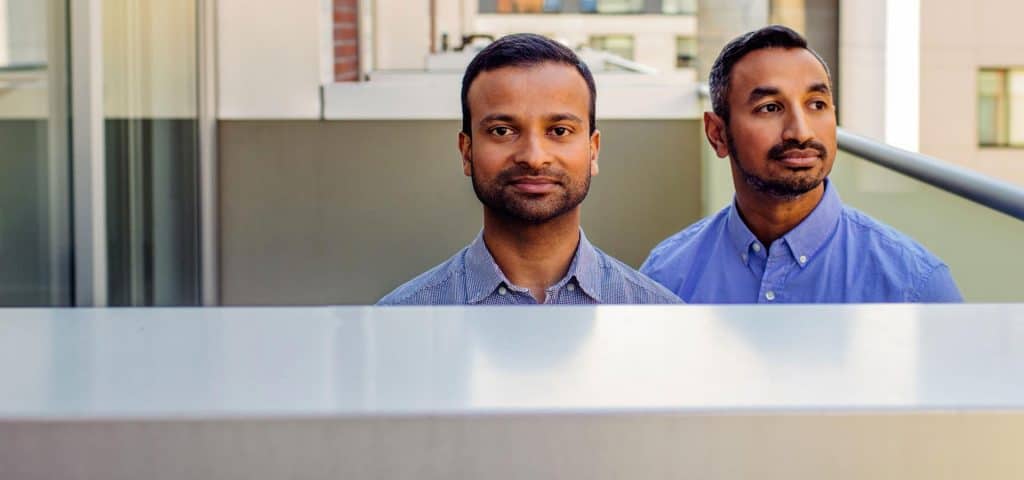

That conversation, in 2015, started Cyriac, now 36, and Uralil, now 37, on the path to launching Lively, a VC-backed startup that aims to offer health savings accounts that meet Millennials’ expectations for financial products: low (or at least transparent) fees and easy to manage online. Four other fintech startups have HSAs in beta testing.

In 2003, Congress authorized HSAs as tax-shelter bait to lure families into high-deductible plans, which—the theory went—would turn them into more cost-conscious healthcare consumers. At the end of January, Americans held $60 billion in 26 million HSAs, an average of $2,300 per account, reports HSA advisory firm Devenir. Still, that’s a pittance compared to how big the pot could grow if Millennials embraced HSAs as they have 401(k)s; more than 90% participate in employer-sponsored retirement plans when eligible, the National Institute on Retirement Security reports.

If you’re covered by an eligible high-deductible health plan, in 2019 you can contribute up to $3,500 for an individual or $7,000 for a family to an HSA, reducing your taxable income by that amount. HSA money is tax-free when withdrawn, provided it’s used to pay for medical, dental or long-term care expenses. Here’s the key: You don’t have to use what’s in your HSA right away. Instead, you can invest and let your money grow for decades tax-free, so long as you, or a surviving spouse, eventually use it for medical expenses. An HSA can even serve as a backup rainy-day fund; should you suddenly need cash, you can take money out tax-free to reimburse yourself for any prior years’ medical expenses paid from outside the account. Plus, once you turn 65, you can withdraw money for nonmedical uses, paying the same tax as you would on withdrawals from a pretax 401(k).

When they first discussed medical expenses, Cyriac and Uralil already knew a bit about HSAs, both their tax advantages and their drawbacks in practice. Cyriac, a computer engineer by training, had spent two years running operations at Justworks, a New York cloud-based payroll and benefits provider. Uralil, with an M.B.A. from MIT, was running operations at Boston-based Retroficiency, which sold software to monitor buildings’ energy efficiency. He oversaw company benefits, including an HSA, which, he says, had a terrible interface and forced participants to keep their savings in cash. (Most of the 2,600 HSA providers in the U.S. are small banks and credit unions that offer only savings accounts and CDs.)

The friends decided they could do better with a digital-native product. In mid-2016, Cyriac quit his new job at payments company Worldpay in San Francisco and rented space at WeWork, becoming Lively’s CEO. Startup funds of $600,000 came from friends, a Worldpay executive, the founder of Justworks and PJC, a venture fund that had backed Retroficiency. New dad Uralil held on to his day job longer, moving out to San Francisco in January 2017, just in time for the two to begin an intensive 12-week stint at famed incubator Y Combinator.

By March 2017, Cyriac and Uralil had Lively’s simplified HSA, with its exclusively online administration, up and running. By that October, they had added investment options through a brokerage account at TD Ameritrade and had an additional $3.5 million in funding from a group that included NBA star Kevin Durant. This past October, Lively raised $11 million to fund expansion. Its 28 employees now work in a loft space opposite San Francisco’s ballpark.

Most of the $100 million in HSA assets Lively has gathered so far has flowed in through word of mouth and online reviews. Its website features videos, snippets of advice and a “no paper cuts” boast. Lively’s first iOS app is due to launch in April.

The founders generated early buzz by offering basic individual HSAs for free—plus, later, $2.50 a month if you wanted a TD Ameritrade account. While just 13% of HSA assets are in individual plans, interest in them is strong among self-employed folks and job hoppers rolling over HSA accounts. Lively’s small business plan has attracted employers seeking to move benefits administration to the cloud. Zaid Ashai, CEO of Nexamp, a solar company in Boston, says he’s switched to Lively for HSAs and fintech startup Guideline for 401(k)s to reduce HR overhead and attract Millennials. “It’s a differentiator in recruiting.’’

Make no mistake: Lively faces some stiff competition, and not just from startups in beta testing. Last November, Fidelity Investments added fee-free individual HSAs to its lineup of employer HSA plans. “We’re positioning HSAs as a critical component of employee retirement savings,” says Begonya Klumb, head of Fidelity’s $4.1 billion-in-assets HSA operation. Lively responded by dropping its $2.50 a month charge for a TD Ameritrade account.

Mark Selcow, a partner at Costanoa Ventures, which led Lively’s $11 million round, figures there’s plenty of growth to go around. “HSAs are underutilized and under-optimized by consumers,’’ he says. No kidding. While 26.1 million adults under age 65 now have health insurance plans with HSAs, the Employee Benefit Research Institute estimates another 57 million could opt for them through their employers, the Obamacare exchanges or the private market.