Publishing numbers about the level of investment in core technologies can lead to something of a self-fulfilling prophecy, as investors use such data to influence their own investment strategy.

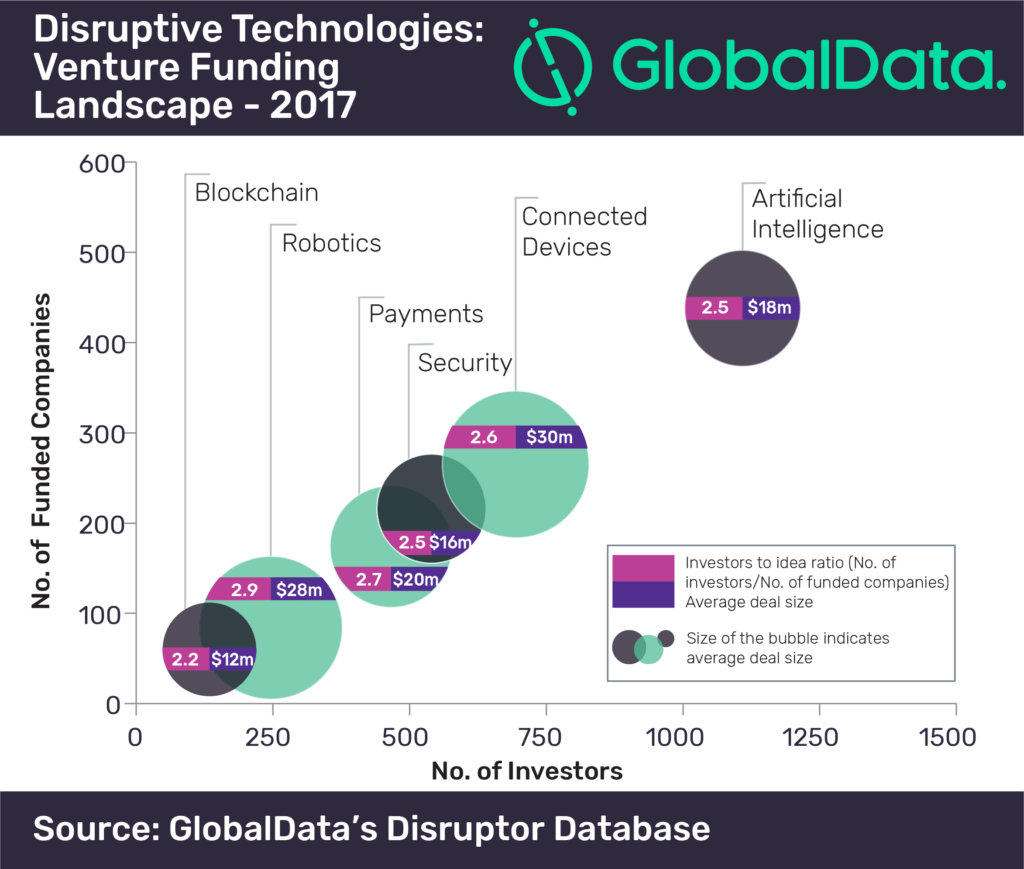

Nonetheless, GlobalData has laid out how the money flowed last year both by charting the number of investors and the number of companies that received investments. And for good measure, it sized the circle of each intersection by the size of the investment.

Bringing up the rear is blockchain and robotics. The former is a bit of a surprise given the hype around the space and its near endless applications, but we can expect momentum to pick up in 2018.

Payments, security, and connected devices garnered more activity, with connected devices attracting the largest dollar volume of investment.

Finally, artificial intelligence—another space with broad applicability—took the crown in terms of deal flow, attracting over 1,000 deals distributed over more than 400 companies. With only $18 million invested, AI attracted fewer dollars than other categories, which may reflect earlier stage investment, something it may have in common with blockchain.

Of course, many of these categories are inextricably linked, and the development of one may help to develop the potential of the others.