Malta has made it obvious that it wants to become the “Blockchain island” and it seems determined to achieve its goal.

A notable confirmation that Malta is moving in the right direction regarding Distributed Ledger Technology (DLT) regulation was the recent announcement by Binance. The largest cryptocurrency exchange in the world by volume chose Malta for their new headquarters after the warnings received from Japan, China and Hong Kong.

Binance CEO Changpeng Zhao, known as “CZ”, welcomed other projects to Malta such as Tron:

Silvio Schembri, Junior Minister for Financial Services, Digital Economy & Innovation within the Office of the Prime Minister of Malta, commented to Cointelegraph on the news:

Binance’s decision is a vote of confidence in what we’re offering as a country and as a Government in this sector, that is legal certainty in this space. During the meeting with CZ I explained our long-term vision reflected in the policy document that was launched in February, ‘Malta – A leader in DLT Regulation.’ We are not shying away but instead want to unleash the opportunities that holds by regulating the sector without stifling innovation. Ultimately our vision is to make Malta ‘The Blockchain Island’.”

Why has Binance moved to Malta?

Binance wants to offer fiat-to-cryptocurrency deposits and withdrawals which will improve its liquidity and open their platform to new investors entering the space with fiat purchases. Currently, very few exchanges offer this option, which forces investors to look for other hedging alternatives such as the stable token Tether to protect themselves from the high volatility and correlation of the cryptocurrency markets.

Malta has warmly welcomed Binance, which hopes to start soon partnerships with local Maltese banks to enable fiat-to-cryptocurrency deposits and withdrawals within a few months.

The second goal of Binance’s roadmap in Malta is to mitigate the risk posed by their centralized system and provide their customers with a decentralized and trustless solution not only due to an ever increasing demand for ultimate security and transparency but also because of the competition that centralized platforms will face from projects such as Polkadot or Cosmos Network.

These new interoperability entrants, by implementing solutions such as “Peggy” (Ethereum Peg Zone), could trigger the raise of a new kind of decentralized exchanges which can be based on, for example, the 0x protocol, allowing for not only token but also cross Blockchain value exchange.

Furthermore, in the near future, these exchanges could be done in a fully anonymous manner thanks to other interconnected privacy focused chains such as ZCash and its Zk-STARKs or Sentinel Security and its built-in coin mixer.

It is therefore unsurprising that one of the goals of Binance in Malta would be to develop its own decentralized exchange given their awareness of all the upcoming innovations and potential competitors.

Ian Gauci, legal expert for the National Blockchain Strategic Task Force within the Office of the Prime Minister, provided Cointelegraph with his opinion about Binance’s decision to move to Malta:

Usually operators opening in Malta would look at the whole ecosystem and assess the country’s potential from that angle. On the DLT front, Malta builds on the excellent reputation and track record in gaming, maritime and financial services. Hence, in my view, the value is already there. This value is further augmented by the country’s predisposition to DLT and innovation and the recent announcements on the intended legislative framework in this sector. I believe this was a crucial aspect in attracting Binance and in all likelihood other outfits on DLT and in the crypto sphere might share Binance’s view and likewise come to Malta.”

Also, a founding member of the Blockchain Malta Association, Leon Siegmund, shared with Cointelegraph his thoughts about the current developments in DLT regulation in Malta:

Entrepreneurs in the Blockchain field need a business environment and clear, simple rules that are long-term guaranteed. Binance delivers a service trusted by millions of users worldwide and provides high quality employment of which the Maltese economy will benefit. Ultimately, it is undoubtedly clear that blockchain and Bitcoin is beyond the stage of being just a hype or underground experiment with millions of people investing – it will bring decades of prosperity.”

Maltese Blockchain regulations

Malta has been proactive and efficient in its efforts to provide a legal framework for DLT. A consultation document related to the enactment of three proposed pieces of legislation was open for feedback until early March. These three pieces of legislation are summarized as follows:

– MDIA (Malta Digital Innovation Authority) Bill

Firstly, the MDIA Bill will consist on the establishment of an authority, the “MDIA”. The Minister responsible for Digital Economy will select the Chairman and Board of Governors of the MDIA. The MDIA Bill will also establish the Joint Co-ordination Board (JCB) and its scope will be to ensure effective cooperation between MDIA and other National Competent Authorities (NCAs) in the area of technology uses.

Moreover the MDIA Bill will establish the National Technology Ethics Committee (NTEC) which will ensure that the proper standards of ethics are reflected in the use of relevant Technology Arrangements and to guide other NCAs in Malta.

– Technology Arrangements and Service providers (TAS) Bill

The second piece of legislation will be the TAS Bill which will set out the regime for the registration of Technology Service Providers (auditors and administrators of Technology

Arrangements) and the certification of Technology Arrangements (DLT platforms and related smart contracts).

The MDIA will be the national competent authority responsible for these registrations and certifications. The proposition is that any person will be able, on a voluntary basis, to request the MDIA to certify a Technology Arrangement or to register a Technology Service Provider.

– Virtual Currencies (VC) Bill

Finally, the VC Bill will provide the regulatory regime and framework for Initial Coin Offerings (ICOs) and for the provision of certain services related to VCs. This regime will cover brokers, exchanges, wallet providers, advisors, wealth managers and market makers dealing in VCs.

Some examples of practical applications of the above proposed legislation would be the certification of a DLT platform or the approval of an ICO. The proposed framework is intended to be pragmatic and applied to regulate the carrying on of business related to VCs when falling out of scope of existing European Union (EU) or Maltese financial services legislation.

A “Financial Instrument Test” will be applied to issuers and/or persons offering ICOs conducted in or from Malta to determine whether an ICO/VC is classified as a financial instrument in terms of existing investment services legislation such as the Markets In Financial Instruments Directive (MiFID).

This “Financial Instrument Test” will have two stages. The first one will be to determine whether a particular VC falls under EU or Maltese existing legislation. The second stage would then determine whether the VC qualifies as an asset under the VC Bill. An affirmative determination during the first stage would not require the person undertaking the test to proceed to the second stage.

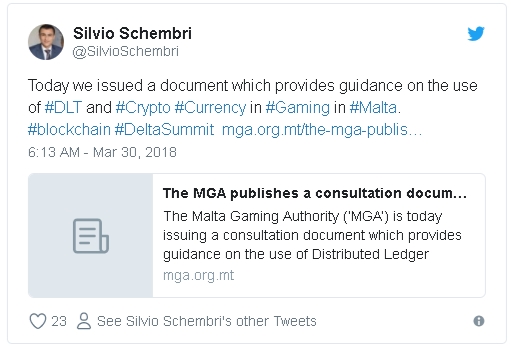

The prime minister of Malta, Joseph Muscat, and Silvio Schembri, Junior Minister for Financial Services, Digital Economy & Innovation within the Office of the Prime Minister, tweeted about their enthusiasm, leadership and constant meetings with operators within the DLT sphere wishing to move to Malta:

Towards more adoption

Ledger projects based in Malta have created LP 01, the first DLT application in Malta consisting of a property transfer management system to facilitate notarial work. This platform could be a useful tool for authorities to access real-time data about sales of property in Malta.

Also, E&S, which is a leading boutique law firm in Malta, would offer services related to ICOs such as ICO set-up, legal services or tokenomics. Several companies are already accepting Bitcoin payments in Malta and there are Bitcoin ATMs present as well. This illustrates a growing use of DLT in Maltese society.

The local press is also discussing DLT issues frequently as can be seen in some recent articles from Times of Malta, Lovin Malta or Malta Independent.

The frictions among regulations, privacy protection and innovation continue. However, while some countries choose not to dialogue or embrace these breakthrough DLT innovations by updating and improving their existing legislation, other countries such as Malta have the courage and initiative to be pioneer leaders. Malta, with the proposed legislation and Binance’s announcement to move its headquarters there, is quickly positioning itself firmly to truly become the “Blockchain island”.