Just when you might think that the video and mobile game space has lost its mojo, along comes a Candy Crush or Pokémon Go game that sends its developer’s stock soaring.

Together, those two mobile game properties managed to generate a massive $2.5 billion in revenue and made a lot of investors wealthy. And there are plenty more where that came from.

The shift to mobile gaming has opened the door for savvy companies that understand how to monetize mobile games and generate hit gaming properties.

We’ve discovered just such an operation in Tapinator, Inc. (OTC: TAPM), an innovative young company that has positioned itself for success at the forefront of mobile gaming.

This is a stock poised for moves now. We are convinced it is severely undervalued and investors can take advantage of the lull that has left most reviewers focused on other tech stocks.

We break out the company in some detail, but we believe that this is an easy double or triple based on its current position and potential for major upside using a solid formula that’s already put Tapinator, Inc. (OTC: TAPM) on track for major growth and revenues, which we will thoroughly get into detail below; it’ pretty shocking to say the least!

Mobile Gaming Success Is About Pigs and Chickens

A quick question: Were you one of the 8+ million players who downloaded and played the wildly popular mobile game Farmville on a phone or tab? If you were, you now understand how to run a farm.

Creating a successful mobile gaming company is a lot like that; in order to be really successful, you need pigs and chickens.

You need chickens to lay eggs every single day. Chickens are cheap and expendable. They constantly produce food and support the farm’s immediate needs with little care or upkeep.

Pigs, on the other hand, take time and real effort to raise. They require constant care and attention. And they are not cheap to feed. However, pigs offer the really big pay-off. One prize pig can fill the freezer for an entire winter or if sold at market, a pig can pay payback the initial investment many, many times over.

The key is having a mix of enough chickens to get to the point where you cash in a prize pig.

This is the scenario that faces nearly every mobile and video game company. They must find an effective mix between immediate revenue producing games and those marquee titles that are true company makers.

Apparently mobile gamers, Tapinator, Inc. (OTC: TAPM) learned this lesson early on and have built a robust formula for success that is a careful balance between low-cost, rapid turnaround games, and big name titles that could easily be the hit wonders of the year.

Several of their games have already earned the distinction of “New Games We Love” on the Apple iOS platform.

Finding a company in the unique position of having a history of valuable game properties and a path to develop blockbuster type franchises is rare. We urge readers to carefully consider that there are only a few public mobile gaming companies with these qualities – yet still trading at pennies per share.

For this reason, Tapinator, Inc. (OTC: TAPM) deserves your attention.

A Market This Size Is Worth the Effort

If you have not tracked the video and mobile gaming space recently, you may be surprised at just how large and lucrative it really is.

Video gaming has become an increasingly relevant force in entertainment and part of everyday life. From 1989 to 2013, the global video game industry, including mobile revenue, grew at a compounding annual growth rate (CAGR) of 11.3% from about $19.9 billion to $76.0 billion. (1)

That is a massive global market that has created a lot of wealth. A large part of its growth comes from the rise of new platforms with capacity for video gaming.

From arcades and consoles like the NES and the Atari, games quickly shifted to personal computers and finally, the internet which opened the way for browser-based gaming. The next step in evolution was smartphones and tablets with the ability to download video games through app stores.

Gaming is now easily accessible on a variety of platforms and as we all know, mobile games are played virtually everywhere on a 24/7 basis.

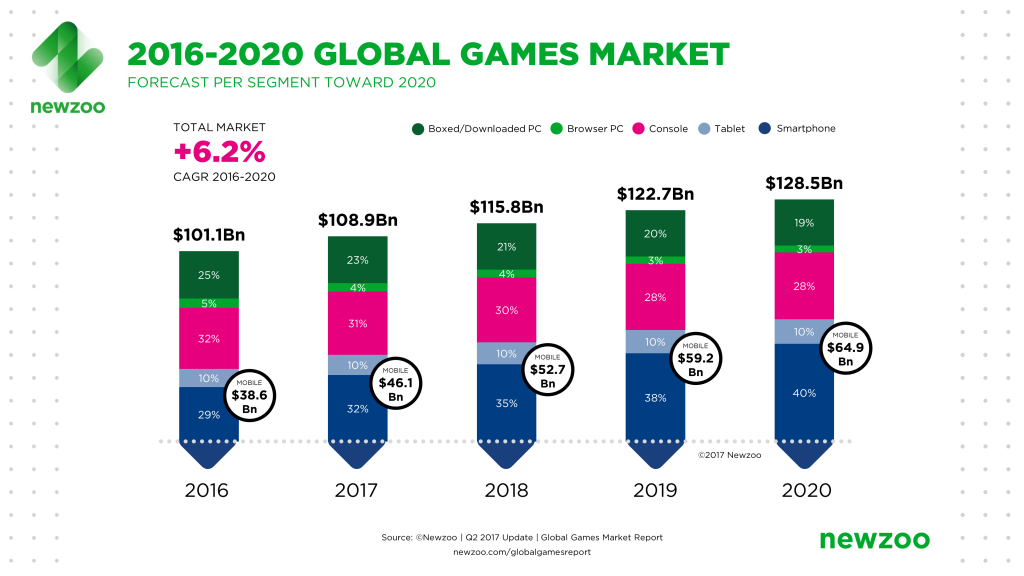

The global video game industry is projected to grow at a CAGR of 6.2% from $101.1 billion in 2016 to $128.6 billion in 2020 according to research by Newzoo, which tracks all gaming.

Mobile gaming, which refers to gaming on smart devices such as a phone or tablet, is expected to be the segment that will experience the highest growth. Newzoo’ s projections show mobile gaming revenue growing 68% from $38.6 billion in 2016 to $64.9 billion.

It would be easy to dismiss the gaming market since there are many more game flops than there are winners, but that would be a serious mistake.

The industry tailwind is with the mobile segment that Newzoo called the “most lucrative segment” of the gaming industry and predicts 19% year-over-year growth. Newzoo also says mobile gaming will represent over half of the total games market by 2020 (2).

Tapinator Inc. has the Right Mix of Games and Know How to Monetize Them

Founded in 2013, Tapinator (OTC: TAPM) is a mobile gaming company successfully creating gaming apps for iOS and Android. The company is based in New York with product development teams located around the world.

Its leader is visionary CEO Ilya Nikolayev, who is credited with creating one of the first successful Facebook applications. That app was eventually sold to Intelius, bringing substantial returns to early investors. Nikolayev is recognized as an industry expert. He is featured regularly on Fox Business, Bloomberg and TheStreet for his insights into the mobile gaming business.

Under his guidance, the Tapinator team has developed and published over 300 mobile gaming titles that have collectively achieved over 400 million player downloads.

That is no small feat in the highly competitive mobile game and app business.

All the hard work and perseverance has earned Tapinator a strong reputation and recognition in publications such as Forbes, Fortune, Venture Beat and The Huffington Post. The collective opinion of reviewers seems to echo our view: Tapinator is a “mobile gaming company that has found a balance between profitability and creativity.”

Again, it’s all about the mix of pigs and chickens.

Tapinator Makes Mobile Games That Make Money

Tapinator’s business strategy, which has served them well, relies on developing and publishing a continuous flow of Rapid-Launch Games at low-cost with reliable return, while developing and publishing costlier Full-Featured games that offer more in-depth content and support long-term engagement.

In order to make this formula work, their experienced team of developers, strategists and product specialists have established serious expertise in building scalable, quality gaming products across various categories. They use a proprietary set of development processes that depend upon key factors such as gaming category, estimated player retention, and projected profitability.

In other words, Tapinator (OTC: TAPM) knows exactly how much to put into a game in order to get the best return before they even begin.

The Company’s portfolio of over 300 mobile gaming titles generate hundreds of thousands of daily player downloads. They provide predictable and attractive returns through the sale of branded advertisements and consumer app store (“in-app”) transactions.

Tapinator’s game universe is significant. Simply search “Tapinator” in the Apple Store or Google Play Store and you’ll see the deep catalogue of choices.

The best-in-class Full-Featured Games (ie. the pigs), such as ROCKY™ and Solitaire Dash, provide game players with more in-depth, unique content that supports long-term retention and generates higher investment returns.

This is the model that creates the potential for sustainable $100+ million franchise-type games that have product lifespans of at least five years.

The company’s base (ie. chickens) are its Rapid-Launch Games. These are typically low-cost, quick to develop (like 90 days or so), follow a known theme and capitalize on short player engagement times.

Recent successful launches of two new Full-Featured titles – Big Sport Fishing 2017 and Dice Mage 2 – were recognized on the Apple iOS platform as “New Games We Love.” Big Sport Fishing 2017 received well over 520,000 player downloads during the game’s first seven days after global release.

Four new titles, ColorFill, Divide & Conquer, Shadowborne and Fusion Heroes, are in the pipeline for release in Q4 2017 and Q1 2018.

The company’s Rapid-Launch Games division also saw increasing player interest recently with the launch of Fidget Spinner Superhero and Scary Shark Evolution 3D.

Tapinator’s diversified revenue sources currently break out as 54 percent from advertising placed within its mobile games, and 46 percent from consumer app store (“in-app”) purchases.

For better gaming experience and engagement, Tapinator limits advertising placements to between game levels. It also runs rewarded video ad units that are tied directly into the game’s currency, again upping the in-app purchase return.

Out of Tapinator’s portfolio of more than 300 active titles, no single game accounted for more than 25 percent of total revenues during the first half of 2017. That is the result of a well-planned and carefully executed corporate strategy.

Plenty of Upside in AR (Augmented Reality) and VR (Virtual Reality)

Tapinator (OTC: TAPM) is a forward-looking company. They see their opportunities in Virtual Reality (VR) and Augmented Reality (AR) – two gaming areas that show great promise.

Virtual reality games are pretty straight forward, involving the player in a virtual environment, but for those unfamiliar, Augmented Reality is use of real world imagery and involvement combined with game play. The most successful AR game is Pokémon Go, which ties real GPS locations to mobile devices so players can find Pokémon characters that appear on screen in the real world.

Tapinator is already hot on this path. They have released several prototype VR games to gather data before pursuing a more significant VR product.

Recent market reports suggest that the VR industry will hit $30 billion by 2020 and the AR industry will surpass that with a projected $120 billion.

Tapinator also plans to pursue publishing transactions that leverage its network, platform relationships and operational excellence. For instance, Tapinator is able to use its cross gaming exposure to hundreds of thousands of players without incurring marketing costs for new games. This has proved very successful.

There are also significant opportunities for expanding Tapinator’s gaming IP to new platforms like Steam and leading messaging apps on the horizon.

With no significant changes in its core development group, the company is targeting a 30% plus annual growth for 2017 to 2019.

The Moonshot Scenario

In looking at the mobile gaming space, we can’t help but mention the potential for a moonshot gaming application. It’s happened time and time again, and the companies that are successful go rocketing skyward, rewarding investors richly.

This is the scenario where a single game takes flight from the simple, every day interest level into a blockbuster title worthy of an entire franchise. These are games like AngryBirds™, CandyCrush™ and Clash of Clans™.

This could easily be the fate of one or more of Tapinator’s gaming properties.

Remember that the little know game development companies that put those iconic titles in play were doing exactly what Tapinator is doing now; building quality game experiences guided by player engagement and variations on popular themes.

This brings up the other specter for Tapinator: acquisition.

With or without a rock star game app, smaller gaming companies can become very attractive to the big players. Leaders in this space continually look for real value in the game properties and the organizations behind them.

Tapinator is a well-run company. It has a solid history for building quality games and it has allied itself with meaningful franchises. One “winning” game property could send ripples across the industry and up the stakes immediately.

If Tapinator were to become a target for the major mobile app companies, we expect that the stock could offer returns that are 10x or even 20x its current value, based on the speculation.

FEATURE STOCK: FOR COMPARISON

[table id=27 /]

Gaming Winners: Too Late for Big Gains, But Excellent to Study

We highlight some of the biggest winners in the video and mobile industry this year to date. These are large cap stocks that have made the meteoric ride with marquee game titles and franchises that bring in hundreds of millions of dollars. They exemplify what happens when a solid gaming company with a proven formula continually produces a mix of money making games and big “hits” that drive value.

[table id=28 /]

Our Recommendation: We Give TAPM Our Strong BUY Rating

After our extensive review, we strongly believe that TAPM is one of the best mobile game companies we have encountered. We also think it is very undervalued, based on its early successes and upside potential.

TAPM’s strategy of capturing active user engagement through quality content and driving in-game purchases will continue to help the company achieve recurring and predictable cash flow on an ongoing basis.

The effectiveness of this strategy has been evident with the success and profitability of other companies with their big name titles like Activision’s Overwatch, World of Warcraft and many others.

At the same time, TAPM continues to grow its user base and solid revenue path with the low-cost, rapid turnaround games that helped to put it on the map.

Gaming companies in the mobile space have to walk a precarious line, but Tapinator, Inc. has managed to find its balance over several years. They have realized that mobile gaming is a lucrative technology- and analytics-driven business.

Photo: Tapinator, Inc.’s popular game titles include major franchises like “Rocky”

Now, they appear ready to use their proven formula to create some major successes, both in conventional gaming and the VR and AR space. Targeting 30% plus annual growth over the next two years is not unrealistic, since they have constantly reached their stated goals.

It would also not be unheard of for Tapinator’s team to come up with a blockbuster game either, since that what they are in the business to do.

If it were not for the experience of the company’s CEO Ilya Nikolayev, we might wonder if they could handle that kind of growth and expectations that places on a smaller company. But Nikolayev and the team are hardened by battle over a decade of development together. That gives us a level of confidence not found in other emerging companies.

We recommend that investors look for value in mobile apps now, while the industry is relatively quiet and plodding along with its solid 19% y-o-y growth.

Investors who are willing to seek out the unique gaming situations like TAPM may find that it can offer outstanding rewards, even if it takes as much effort as finding an elusive Venusaur, Blastoise, or Charizard in Pokémon Go. It can be worth it.

USA News Group

Editorial Staff

Sources:

(1) Video gaming market : https://newzoo.com

(2) Mobile growth: (https://dtn.fm/wBd1R).

Disclaimer

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. USAnewsgroup.com is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee $30,000.00 USD directly from the company for Tapinator, Inc. advertising and digital media. We expect further compensation to carry through a more comprehensive advertising campaign. There may be 3rd parties who may have shares of TAPM, and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this newsletter as the basis for any investment decision. The owner/operator of USA News Group owns shares of TAPM which were purchased in the open market, and have no plans on selling any shares within the next 72 hours of this publication date (Oct. 29, 2017), at which point we reserve the right to buy and sell shares of TAPM without any further notice.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.