Current market conditions coupled with World climate has put certain Iron Ore focused companies in a position to possibly outperform big mining companies.

Several companies in this vein are attracting interest and one junior miner in particular, Black Iron Inc. (TSX: BKI, OTC: BKIRF), has a strong formula for success and low-cost production.

The market for iron ore has been hot, especially for higher grade ore. Big mining companies with massive iron interests have seen a rally of investor support because of their low valuations, high earnings and big dividends. Rio Tinto for instance paid its largest interim dividend in its history last month.

But things are shifting. The demand for steel from China, the major consumer of iron ore, was dampened in September as that country slowed its forecast based on economic output and said it would lessen steel production during winter to help curb pollution (1).

Interestingly, other Asian countries including India and Vietnam look like they will take advantage of any price drop in iron ore and buy in. That should offset any lack of demand from China and put iron ore back where it was headed: up once again.

For those uncertain about the potential gains in iron ore, consider one well known mining company focused completely on iron ore: Cleveland-Cliffs jumped 12% in August 2017 alone (2).

That’s just one good reason to look at pure iron ore focused companies right now.

As our readers know, we are very positive on the junior mining sector. Many investors have done very well this year in that end of the market. That is why we suggest taking a hard look at Black Iron Inc.(TSX: BKI) (OTC: BKIRF), which is developing a large iron ore project in Ukraine to production.

We like the play, we like the economics and we think you think you’ll agree that the company can double or triple gains made by the more diversified miners, based on its unique opportunity.

You Could BUY a Pure Iron Ore Mining Stock at Pennies Per Share. See Our Recommendation.

Iron Ore Companies Have Been Good to Investors

If you take a moment to review the leaders from our Winners List (below) you’ll likely recognize that these are very large mining companies, save for one iron ore only miner. Our top three selections had a one year return of 54.66%, 19.53% and 92.03% respectively (4). This group has provided strong dividends and solid value.

The challenge for many investors is that these big board stocks trade in the over $40 to $50 a share or above range. They’re comparatively stable, but they already have any large gains and speculation built in to their pricing.

In order to achieve leverage, like 10 to 1, 20 to 1 or better, we realize you need to look at the early stage mining business with the focus on an immediate path to production and a means to expand the resource.

That is the exact description of Black Iron Inc.

Black Iron’s Ukraine Location is Pivotal to Its Success

Black Iron Inc. is a junior Canadian mining company advancing its 100% owned Shymanivske Project located in Kryvyi Rih, Ukraine, to production.

The project is located in an established mining region with five other operating iron ore mines in close proximity.

Black Iron has been at work in Ukraine since 2010 to develop this large scale project and was moving to production, but they were delayed when Russia decided to invade Eastern Ukraine and the Crimean Peninsula Region in 2014. Things have since stabilized in the rest of Ukraine and global consensus is that if Putin wanted to take the rest of Ukraine, he would have already done it. He has apparently achieved his strategic objective of securing the country’s naval base and assets most valuable to Russia.

After more than three years of stability, its business as usual in the rest of Ukraine including the region where Black Iron is located.

Black Iron has really moved into high gear as world iron ore economics have been ramping up.

The Shymanivske Project contains 646 million tonnes measured and indicated resources grading 31.6% iron and 188 million tonnes inferred resources grading 30.1% iron.

A bankable feasibility study for the project completed in 2014 provides excellent economics for 9.9 million tonnes per year of 68% iron ore concentrate production, including a Net Present Value of US$3.3 billion at an 8% discount rate and before tax Internal Return Rate of 48%(3).

As a rule of thumb: for base metal projects an after tax IRR of at least 15% is preferred by financiers of mining projects.

Importantly, since the report was issued, the Ukrainian currency (Ukrainian Hryvnia) has depreciated significantly, currently at around UAH 27 to US $1. The original value placed on the resource used an exchange rate of UAH 8 to US $1.

This means that Black Iron has lowered its costs dramatically from the original estimate based on a very favorable exchange rate, which could easily offset any lowered value in global ore prices.

Black Iron’s high grade of ore (68%) also fetches a premium to regular or low grade ores produced in many other regions.

What Black Iron has is a large, bankable ore deposit with significant potential expansion that it is bringing to production. And while the resource itself is the major asset, it’s the location in Ukraine that makes Black Iron’s project so attractive.

Location, Location, Location

As any mining company will tell you, in order to mine ore, you need ready access to move the product to markets, a secure power source and a reliable labor force. Of course being able to access all these at low cost makes or breaks the project.

This is where Black Iron has a potential grand slam.

The project location itself has paved roads to the site and lies just two kilometers from main state-owned rail line. There’s also a surplus of low-cost electricity readily accessible from high voltage power lines that run beside the company’s property. The site is also just 8 kilometers away from the major city of Kryvyi Rih (population 750,000) which has very skilled work force to draw from.

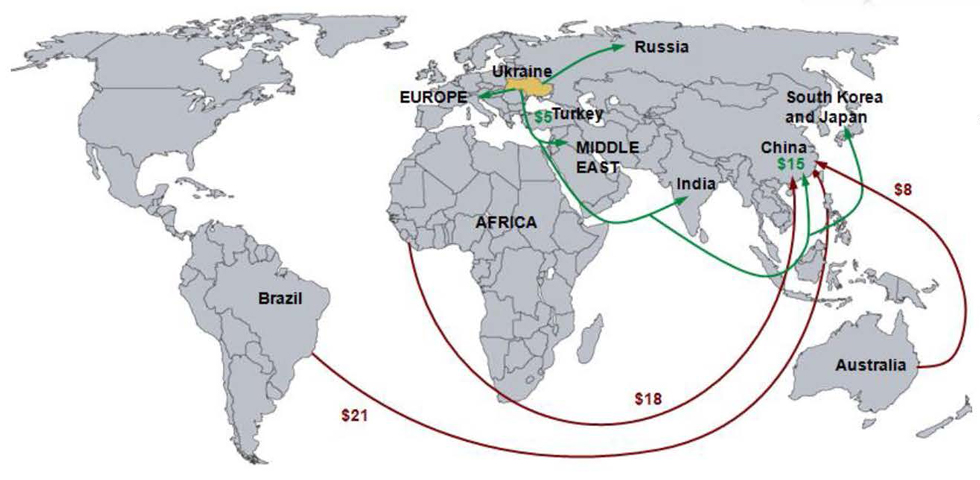

The region where Black Iron operates has rail access to Western Europe and it’s just 140 kilometers to nearest water port providing access to the Black Sea and global seaborne iron ore markets. The obvious targets for its product include Asia, Western Europe, Turkey, and the Middle East.

Besides the favorable exchange rate, Black Iron is also able to able to leverage low-cost electricity, transportation, a skilled work force that makes about $5.00 an hour and all this is rounded out by a highly affordable tax rate paid to the Ukraine government of just 18%.

Besides the favorable exchange rate, Black Iron is also able to able to leverage low-cost electricity, transportation, a skilled work force that makes about $5.00 an hour and all this is rounded out by a highly affordable tax rate paid to the Ukraine government of just 18%.

Ukraine is an ideal spot for this project.

Imagine an IronOre Mining Stock That Could See Returns of 10x, 20x or more! – See Our Recommendation

The Smart Play in Iron Ore: Junior Miners

Leaders in iron ore mining are typically large companies with part of their interests tied to steel production. They likely mine other metals or develop petroleum etc. For really big returns, we seek out early stage companies with strong economics. These are nearly always junior mining companies, as is the case with Black Iron Inc.

Why juniors? They are flexible and able to move quickly to scoop up opportunities. They don’t bear large overheads and they can shift when needed. Obviously they carry more risk than the BIG mining companies, but the returns can be outstanding.

Black Iron(TSX: BKI) (OTC: BKIRF) is a junior mining company that has put itself in a unique position. Their advanced Shymanivske project in Ukraine represents a $3.3 billion asset that ready to move to production with highly capable management and an impressive board. By any measure that is a huge project with legs and real potential for big pay back.

Take note that Black Iron must report its project by mining regulations NI 43-101 standards. However, the company has said that it will update the 2014 NI 43-101 information to reflect current market economics in Q4 of this year.

FEATURE STOCK: FOR COMPARISON

[table id=17 /]

Iron Ore Winners: Too Late for Big Gains, But Still Good to Study

We’ve pulled from the leaders in mining that have seen excellent returns this year already based on their focus on iron ore. Investors enjoy the safety of the fact that they are, for the most part, large and diversified across other mining interests and metals. Unfortunately, that’s the very same reason that these companies are not likely to see the kind of major returns that we are looking for in a pure iron ore player like our feature stock.

Our Recommendation: We Give BKI Our Highest Pure Play BUY Rating

Our scan of the market indicates that there’s a wide variance in the iron ore sector and that spells opportunity. You have to remember that it’s a commodity, so it is affected directly by demand and supply.

Iron ore markets are volatile and moves up of 100% up or down by 70% are the norm.

Despite the volatility, it’s possible to invest in iron ore miners and make outstanding returns, but you have to be aware of the impact of product grade on price, proximity to rail port and power. Not all miners are the same.

Pure play iron ore companies have potential for huge upside in both the short and long term. Short term they offer speculation on iron ore’s upswings. Long term they offer security of a well-established, predictable industry.

Given the competitors, we think BKI has one of the best positions for iron ore out of any in the global junior mining sector. They certainly have a lot going for them.

Their cost of production, location to world markets in Ukraine, ultra high-grade 68% iron content product, existing infrastructure and strong mining management make the company a shoe-in for success. They have the permitting, available labor and a huge resource to grow a valuable iron ore operation.

Ultimately, Black Iron’s Shymanivske iron ore project could be a leading resource in the region. It’s already valued in the billions.

Bottom Line: You can get in on what is a very affordable point in the iron ore trend now. There is the potential for major leverage in backing a junior mining company that has a proven resource, but that is not yet in production.

We are looking for BKI to move to production rapidly, establish operations, ramp up their capacity and expand the overall resource size and valuations.

Early investors, like those that slip in prior to reaching production, could see an immediate double, triple or more from an initial stake. And although the long-term will be determined by supply economics, we feel that steel production and investments in infrastructure that power the iron ore market are solid bets through to the next administration, at the very least.

USA News Group

Editorial Staff

Sources:

(1) Seeking Alpha – https://seekingalpha.com/news/3296562-iron-ore-prices-slide-amid-chinese-demand-doubts-peak-steel-warning

(2) Motley Fool – https://www.fool.com/investing/2017/09/06/why-this-iron-ore-miner-jumped-12-in-august-bestin.aspx

(3) BKI – Bankable Feasibility Study – https://www.blackiron.com/Projects/Shymanivske-Project/default.aspx

(4) Bloomberg Markets – Online as at 10.6.2017 https://bloomberg.com

Disclaimer

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. USAnewsgroup.com is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for Black iron Inc. advertising and digital media. There may be 3rd parties who may have shares of BKI, and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this newsletter as the basis for any investment decision. The owner/operator of USA News Group does not own any shares of BKI.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment